Introduction to Withholding Tax and Imported Services Tax - Implications of Digital Services (PART 1)

Key Takeaway

- Withholding Tax on Foreign Service Providers

- Service Tax on Digital Services

In this present age, business cannot avoid but to rely on digital

services to reach out to their customers and suppliers in order to

operate or enhance their business functions. The reliance on digital

services to conducting a business is accelerated particularly so with

the Movement Control Order (MCO) being implemented in Malaysia

which limits the ability of businesses to continue doing business, the

‘traditional’ way. Some of the most common digital services relied on

by businesses would include software applications, digital advertising,

payment gateways and cloud storage, which are generally dominated

by foreign service providers such as Google, Microsoft and Facebook.

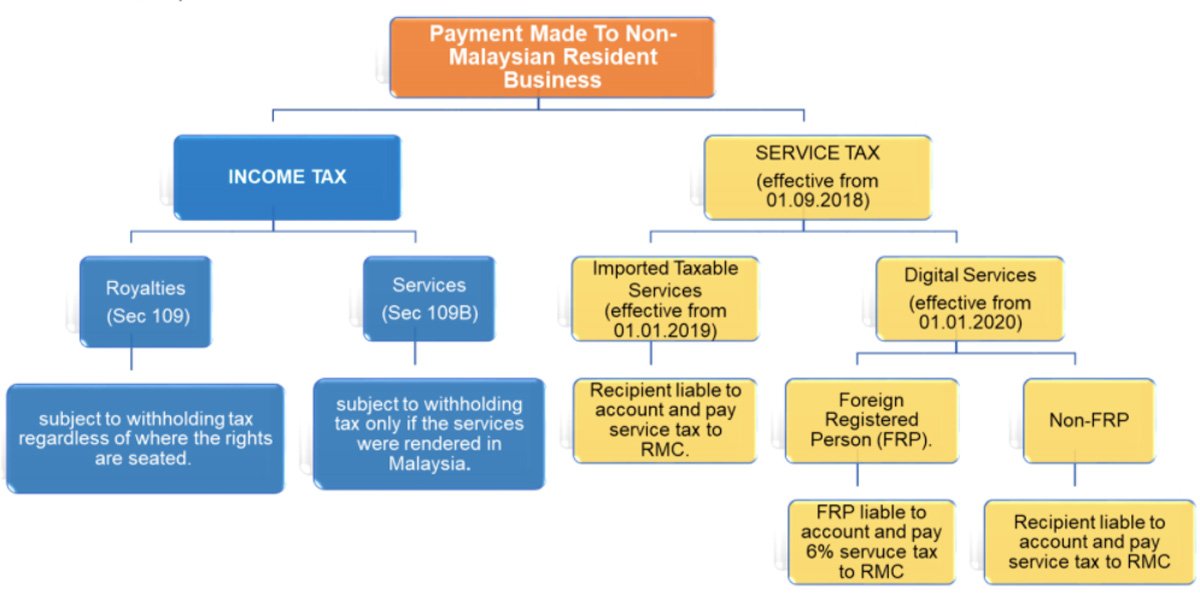

Such digital services would obviously involve payments for the use of such digital services to the service providers and therefore, you have to be aware of the tax implications behind the use of digital service, namely:

This series of short articles intend to provide some general guidance on the tax implications of payments for such services to service providers who are not residing in Malaysia.

Such digital services would obviously involve payments for the use of such digital services to the service providers and therefore, you have to be aware of the tax implications behind the use of digital service, namely:

- Withholding tax under the Income Tax Act 1967; and

- Digital service tax or imported services tax under the Service Tax Act 2018.

This series of short articles intend to provide some general guidance on the tax implications of payments for such services to service providers who are not residing in Malaysia.

You also need to take note that in some cases, both service tax and withholding tax can apply on the same

service, as per the illustration as below:-