Introduction to Withholding Tax and Imported Services Tax - Implications of Digital Services (PART 2)

Key Takeaway

- Withholding Tax on Foreign Service Providers

- Service Tax on Digital Services

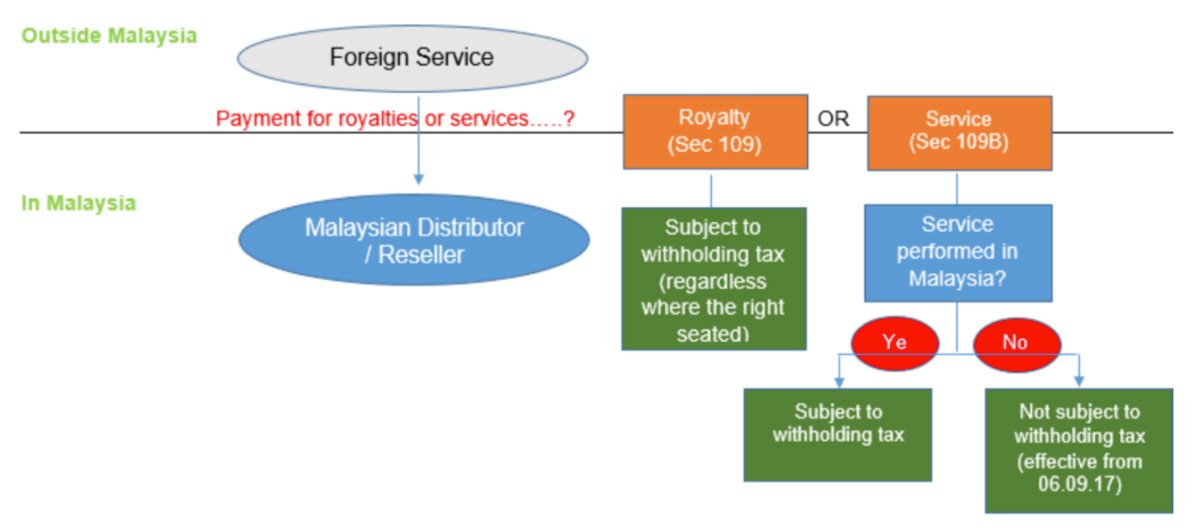

Part 2 of this article will focus on withholding tax issues around

‘royalties’ (Section 109, Income Tax Act 1967) and ‘services’ (Section

109B, Income Tax Act 1967) for e-Commerce transactions.

What is e-Commerce?

Any commercial transactions conducted electronically including the

provision of information, promotion, marketing, supply, order or

delivery of goods and services (even though payment and delivery

relating to such transactions may be conducted offline).

Withholding tax implications

To determine the nature for payment of e-commerce services (i.e

Royalties or Services?)

Example of payments under e-commerce transactions

Online advertising on Facebook, online payment such as Paypal, payment for cloud computing service,

payment for subscription to content aggregators etc.

Important

Payment made may fall under Sec 109 instead of Sec 109B and penalty will be imposed due to non-

compliance with withholding tax rules.