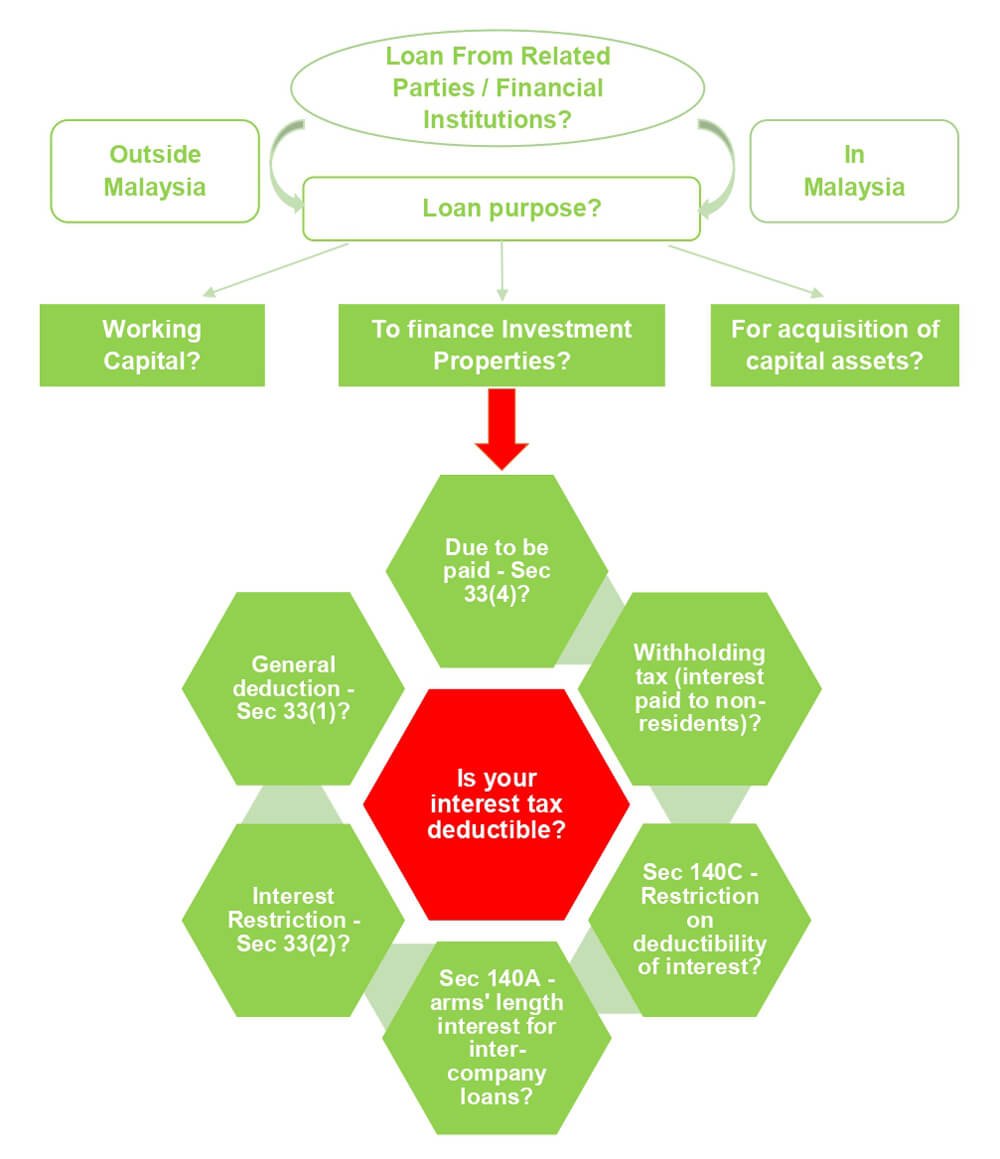

Is Your Interest Tax Deductible?

Key Takeaway

- Deduction rules on interest expenses incurred on loan or borrowings taken for business.

- Borrowing is very important for the businesses. However, the source of borrowing whether is local or overseas; the parties to whom we borrowed from; the purposes of and use for the borrowings will affect the deductibility of the interest.

- Therefore, the rules on interest deductions (borrowing which generate interest expenses) can be complex.

Is Your Interest Tax Deductible?