Price is What You Pay Value is What You Get

a) Business Valuation:

- Business Planning

- Estate, Gift and Income Tax

- Financial Reporting

- Goodwill Impairment

- Initial Public Offering (IPO)

- Litigation and Ownership Disputes

- Marital Dissolution

- Mergers and Acquisitions

- Pre-IPO Advisory

- Reorganisations or Liquidation

- Shareholder Oppression Cases

- Stock Option Plans

b) Intangible Assets Valuation:

Marketing-related:

Trademarks, trade names, service marks, collective marks, certification marks, internet domain names, trade dress and newspaper mastheads.

Customer-related:

Customer lists, order or production backlog, customer contracts and the related customer relationships which meet contractual criterion, and non-contractual customer relationships which meet the separability criterion.

Artistic-related:

Plays, operas, ballets, books, magazines, newspapers, literary works, video and audio-visual materials, musical works, pictures and photographs and artistic works which meet contractual criterion.

Contract-based:

Licences, royalties and standstill agreements, advertising, construction, management, service or supply contracts, lease agreements, franchises, operating and broadcasting rights, use rights such as drilling, water, air, mineral and timber-cutting, servicing contracts such as mortgage and employment contracts and non-competition agreements.

Technology-based:

Patented and non-patented technology, computer software, mask works, databases and trade secrets such as formulas, process or recipes.

c) Brand Valuation

For financial perspective

- Compliance with accounting standards

- Assisting mergers and acquisitions and corporate restructuring

- Intellectual property management

- Strengthening balance sheets and company accounts

- Increasing shareholder confidence which consequently improves the share price

- Providing financial transparency and solid proof to donor and contributors for non-profit organization

For marketing perspective

- Brand management and strategic development

- Enhancing management communications

- Benchmarking of competitors

- Creating a brand-centric culture

- Establishing royalty rates for licensing arrangements

For legal perspective

- Identifying value of intangible asset in an ownership dispute

- Securing funds by value of intangible asset in insolvency situation

- Evaluating economic damage in trademark infringement

- Licensing claim

- Partnership dissolution

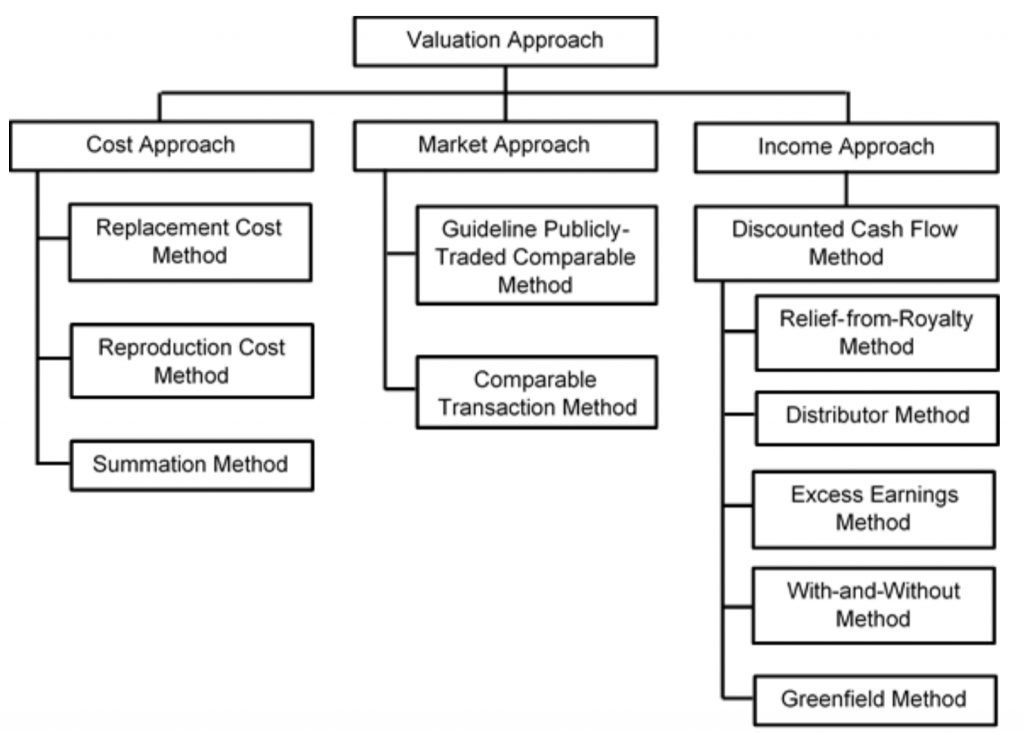

OUR VALUATION METHODOLOGIES

a) Cost Approach

Cost approach is a general way of determining a value indication of a business, business ownership interest, or security using one or more methods based on the value of the assets net of liabilities.

In the valuation of a business, cost approach presents the value of all the tangible and intangible assets and liabilities of the company.

b) Market Approach

Based on the principle of competition, market approach assumes if one thing is similar to another and could be substituted for the other, they would compete with each other, then they must be equal in value. The fair value derived must be based on a sufficient number of comparable companies / market transactions in order to derive a relevant and meaningful comparison.