Transfer Pricing Requirements And New Penalties in Malaysia

Key Takeaway

- Transfer Pricing Documentation is to be prepared annually

- Changes in Form C disclosure items for related party transactions, interest expenses paid to related companies and CbyCR notification

- CbyC Rules are applicable for companies with consolidated revenue of more than RM3 billion

- New penalty rates have been introduced

Transfer Pricing Guidelines (“TPG”)

- Controlled transactions between associated persons, where at least one party is assessable or chargeable to tax in Malaysia; and

- Applies to both cross-border transactions and domestic related party transactions. The TPG need not be applied to domestic controlled transactions if it can be proven that any TP adjustments will not alter the total tax payable by both parties.

- Companies with gross income more than RM25 million, and the total amount of related party transactions more than RM15 million; OR

- Companies with financial assistance by related parties more than RM50 million.

- Organizational structure

- Nature of business/industry and market conditions

- Controlled transactions

- Pricing policies

- Assumption, strategies and information regarding factors that influenced the price setting policies

- Comparability, functional and risk analysis

- Selection of the transfer pricing method

- Application of the transfer pricing method

- Financial information

- Other relevant/supporting documents

A simplified TP documentation consists of items (a), (c) and (d) as detailed below. Taxpayer is allowed to apply any method other than the five methods described in the TPG provided it results in arm’s length outcomes.

(a) Organizational Structure

- the taxpayer’s worldwide organizational and ownership structure covering all associated persons whose transactions directly or indirectly affect the pricing of the documented transactions; and

- a description of the management structure of the local entity, a local organization chart, and a description of the individuals to whom local management reports and the country(ies) in which such individuals maintain their principal offices.

(b) Controlled Transactions

- description of details of the property or services to which transaction relates; any intangible rights or property attached thereto, the participants, the scope, timing, frequency, type and value of the controlled transactions (including all relevant related party dealings in relevant geographic markets);

- names and addresses of all associated persons, with details of the relationship with each such associated person;

- the nature, terms (including prices) and conditions of transactions (where applicable) entered into with each associated person and the quantum and value of each transaction;

- an overview description of the business, as well as a functional analysis of all associated persons with whom the taxpayer has transacted;

- all commercial agreements setting forth the terms and conditions of transactions with associated persons as well as with third parties; and

- a record of any forecasts, budgets or any other financial estimates prepared by the person for the business as a whole and for each division or product separately.

(c) Pricing Policies

- the formula adopted, including anticipated profit margin/mark-up and cost component;

- how the formula is applied;

- who determine the pricing policy & how often is the policy being revised;

- sample of documents to support the pricing policy; and

- comparability study to ensure the arm’s length price.

Income Tax (Country-by-Country Reporting) Rules 2016 (“CbyCR Rules”)

Additionally, there is also a requirement for the Malaysian Companies to notify the tax authorities under Subrule 6(1) and 6(2) of the PU (A) 357/2016 either by disclosing the information as part of the tax returns or by submitting the manual notification form.

Malaysian parent entities and subsidiaries submitting the Form C , TR , TA , TC or TN (tax return forms, whichever is applicable) can furnish the notification by way of tax returns while companies filing Form LE & TF are required to furnish the notification using a manual notification form as follows:

[Annex B1]

[Annex C1 & C2]

a. Notification for non-reporting entities whose reporting entity is in Malaysia

b. Notification for non-reporting entities whose reporting entity is outside Malaysia

Tax Return Form

- Disclosure on whether tax payers carry out controlled transactions under Section 139 and 140A Tax payer is to disclose all type of transactions they are involved in with a related party and the amount. Tax payer would also have to declare if TP documentation have been prepared.

- Disclosure of whether the taxpayer is subject to interest restriction under Section 140C.

Tax authorities introduced Restriction on deductibility of interest under Section 140C of the Income Tax Act 1967, effective 1 July 2019 onwards aimed at restricting the deduction of interest expense in relation to cross border transaction. The Rules are applicable to:- companies who have been granted any financial assistance in a controlled transaction;

- the total amount of any interest expense for all such financial assistance exceeds RM500,000 in the basis period.

- Disclosure on CbyCR

Tax payer is to disclose if CbyCR is relevant for the Group and fill in the relevant information of the reporting entity.

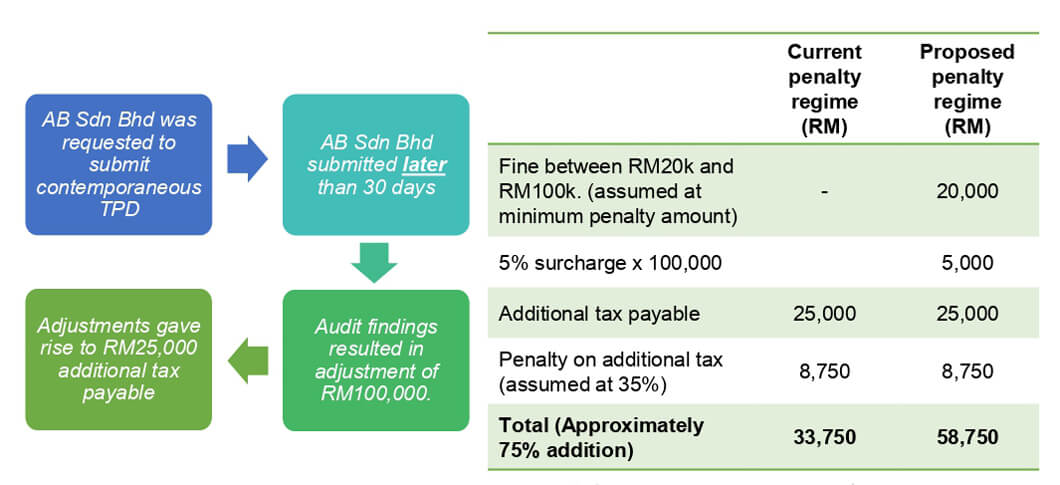

Transfer Pricing Penalties and Power to Disregard Structures

Failure to furnish contemporaneous Transfer Pricing documentation

- Fine of not less than RM20,000 and not more than RM100,000; or

- Imprisonment for a term not exceeding six (6) months; or

- Both.

-

The new section also empowers the Director General to impose a penalty as stated in (a) if taxpayer is

not prosecuted for failure to furnish TP contemporaneous documentation. Taxpayers can appeal on the

decision with the Special Commissioners of Income Tax but the burden of proof is on the taxpayers.

5% surcharge on Transfer Pricing adjustments

Power to disregard structure in controlled transactions

- The economic substance of that transaction differs from its form; or

- The commercial reality of that transaction differs from the arrangement which would have been adopted by an independent party.

Failure to comply (after adjustments have ben issued)

Illustration on Penalties

Transfer Pricing Audit Framework 2019

(Normal Case)

Penalty Rate

(VD)

50%

NA

30%

20%

0%

FAQ: Transfer Pricing in Malaysia

Transfer pricing refers to the rules and methods for pricing transactions within and between enterprises under common ownership or control. The prices set for these transactions are called transfer prices.

Transfer pricing is important because it affects the allocation of income and expenses among related entities, which in turn impacts the taxable income and tax liabilities of each entity. Proper transfer pricing ensures that profits are reported where economic activities occur, preventing tax evasion through profit shifting.

In Malaysia, transfer pricing is governed by the Income Tax Act 1967 and the Transfer Pricing Guidelines issued by the Inland Revenue Board of Malaysia (IRBM). These guidelines are based on the OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations.

All taxpayers involved in controlled transactions with associated persons must comply with transfer pricing regulations. This includes both domestic and cross-border transactions.

A controlled transaction is any transaction between associated persons, including the sale of goods, provision of services, transfer of intangible property, financial arrangements, and other business dealings.

Taxpayers must maintain comprehensive transfer pricing documentation to demonstrate that their transfer prices are at arm’s length. This includes:

- Description of the organizational structure.

- Details of the controlled transactions.

- Functional analysis of the parties involved.

- Economic analysis and benchmarking studies.

- Comparability analysis.

The arm’s length principle states that the prices charged in controlled transactions should be comparable to the prices charged in transactions between unrelated parties under similar conditions.

The IRBM has set certain thresholds for simplified compliance requirements. For instance, companies with gross income exceeding RM25 million and total related party transactions exceeding RM15 million must prepare and maintain full transfer pricing documentation.