Family Office Incentive Scheme in Forest City Free Trade Zone (FCFTZ)

First location in Malaysia which provide 0% concessionary tax rate for family offices. This incentive is valid for an initial period of 10 years and an additional 10 years with further conditions.

Forest City Special Financial Zone (FCSFZ)

Following amendment bills were tabled and passed by House of Parliament in July 2024 and gazetted on 3 Oct 2025, FCSFZ is first onshore duty-free zone and special financial zone in Forest City, Johor, Malaysia.

Pulau Satu, Forest City is the first location in Malaysia to offer a zero (0%) percent tax rate for Family Office established under the Single Family Office Scheme.

Pulau Satu, Forest City is the first location in Malaysia to offer a zero (0%) percent tax rate for Family Office established under the Single Family Office Scheme.

Source: https://forestcitycgpv.com

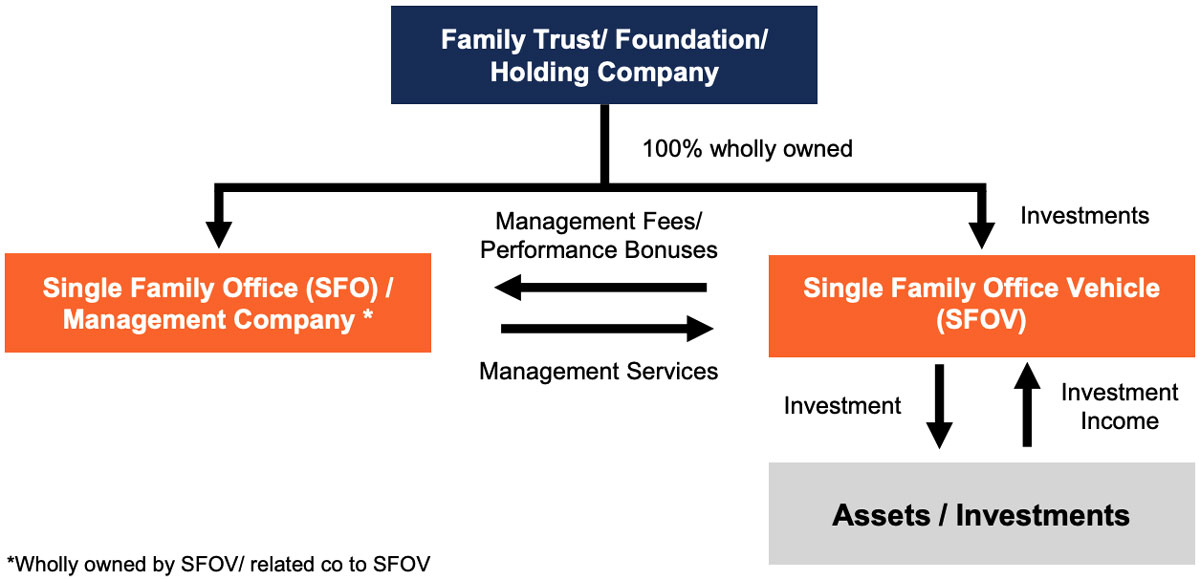

Single Family Office (SFO) & Single Family Office Vehicle (SFOV)

What is Single Family Office (SFO)?

- SFO is a corporate vehicle;

- Wholly owned or controlled by members of a single wealthy family;

- Created to exclusively manage the assets, investments and long-term interests of that family;

- SFO may also represent multiple generations and branches of the family.

What is Single Family Office Vehicle (SFOV) ?

- SFOV is a corporate vehicle;

- Wholly owned or controlled by members of a single wealthy family;

- Established solely for the purposes of holding the assets, investments and long-term interest of members of the single family.

SFO vs SFOV

Key Conditions on SFOVs Tax Incentives

SFOV must be incorporated in Malaysia, preregistered with the Securities Commission (SC), and operating in Pulau Satu,

FCSFZ to be eligible for zero (0%) Concessionary Tax Rate for first initial 10 years + additional 10 years. The below conditions

are also required to be fulfilled during the incentive periods.

Conditions

First 10 Years

Additional 10 Years

1. Minimum AUM

RM30Mil (*USD7Mil)

RM50Mil (*USD11.5Mil)

2. Minimum Domestic

Investment in Promoted

Activities

At least 10% of AUM or

RM10Mil (*USD2.3Mil),

whichever is lower

At least 10% of AUM or

RM10Mil (*USD2.3Mil),

whichever is higher

3. Minimum local operating

expenditure per annum

RM500,000 (*USD115,000)

RM650,000 (*USD150,000)

4. Minimum full time employees

Two (2) and each with a minimum

monthly salary of RM10,000 and of

whom at least one (1) is an investment

professional.

At least 4 full-time employees.

5. Physical Office

Pulau 1, Forest City SFZ

min 450 square feet.

Pulau 1, Forest City SFZ

min 450 square feet.

*1 USD = 4.32740 MYR