Complete Guide to PEO and EOR Services in Malaysia (Costs, Compliance, and Benefits)

But what exactly are PEO (Professional Employer Organisation) and EOR (Employer of Record) services? How do they differ, and what benefits can they bring to your company?

In this guide, we’ll explain how PEO and EOR services work in Malaysia, their costs, compliance requirements, and benefits. We’ll also explore how they complement other professional solutions such as accounting services in Malaysia.

What are PEO and EOR Services?

Professional Employer Organisation (PEO)

A PEO is a co-employment model where your company shares HR responsibilities with a third-party provider. The PEO manages HR functions like payroll, benefits administration, and compliance, while you retain day-to-day control over employees.

Key features of PEO services:

- Payroll and tax administration

- HR compliance with Malaysia’s labour laws

- Employee benefits management

- Risk management and HR advisory

Employer of Record (EOR)

Key features of EOR services:

- Acts as the official employer on behalf of your company

- Manages employment contracts, payroll, and statutory contributions

- Ensures compliance with Malaysia’s Employment Act and EPF/SOCSO requirements

- Allows rapid hiring without establishing a local entity

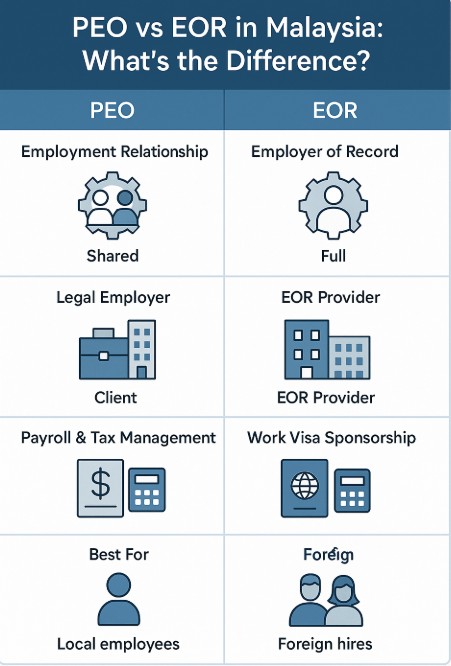

PEO vs EOR: What’s the Difference?

| Aspect | PEO (Professional Employer Organisation) | EOR (Employer of Record) |

|---|---|---|

| Legal Employer | Your company is still the legal employer. | EOR is the legal employer. |

| Entity Requirement | Requires your company to have a Malaysian legal entity. | No local entity needed — ideal for foreign companies. |

| Scope of Services | HR support, payroll, compliance assistance. | Full employment responsibility, contracts, and compliance. |

| Best For | Established Malaysian businesses wanting HR efficiency. | Foreign businesses hiring in Malaysia without setting up an entity. |

Compliance in Malaysia: Why It Matters

Some compliance areas handled by PEO and EOR providers include:

- Employment Act 1955: Covers contracts, wages, working hours, and termination.

- EPF (Employees Provident Fund): Mandatory contributions for retirement savings.

- SOCSO & EIS: Social security and employment insurance contributions.

- Income Tax: Withholding and reporting of employee taxes.

For related compliance needs, see BPO and Business Advisory Services.

Costs of PEO and EOR Services in Malaysia

- Number of employees — Fees are usually charged per employee, per month.

- Scope of services — Payroll-only vs full HR management.

- Customisation — Special benefits, expatriate handling, or multi-country solutions.

- PEO costs: RM800 – RM1,500 per employee/month depending on services.

- EOR costs: Slightly higher, ranging from RM1,200 – RM2,000 per employee/month, as the EOR assumes greater legal risk and compliance responsibility.

While these costs may seem significant, they are often lower than building a full in-house HR and compliance team or setting up a legal entity.

Benefits of PEO and EOR Services

1. Faster Market Entry

EOR services allow foreign businesses to hire staff in Malaysia immediately, without waiting months to register a subsidiary.

2. Reduced Compliance Risks

Both PEO and EOR ensure payroll, contracts, and tax filings comply with Malaysian law.

3. Cost Savings

Avoid hiring large HR teams or spending heavily on compliance systems.

4. Employee Satisfaction

Employees benefit from proper payroll, benefits, and statutory contributions — boosting morale and retention.

5. Business Focus

Leadership can focus on operations, expansion, and strategy rather than HR administration.

PEO and EOR in Action: Example Scenarios

- Foreign Tech Startup: A Singapore-based tech company wants to test the Malaysian market. Instead of setting up an entity, they use an EOR to hire local developers, ensuring compliance and saving costs.

- Local SME Scaling Fast: A Malaysian SME experiencing rapid growth engages a PEO to handle payroll, compliance, and HR, allowing management to focus on expansion.

- Multinational Hiring in Multiple Countries: By using an EOR, the company centralises its hiring in Malaysia without needing to set up legal entities in each market.

The Role of Accounting Services in Malaysia

- Payroll reporting feeds into financial statements.

- Tax compliance overlaps with corporate tax filings.

- Employee benefits may impact accounting for liabilities.

See: Reasons You Need Accounting Services for Business.

FAQs

A: PEO requires your company to have a legal entity in Malaysia and supports HR functions. EOR becomes the legal employer, allowing you to hire without setting up a local entity.

Q2: How much do PEO and EOR services cost in Malaysia?<

A: PEO services typically range from RM800–RM1,500 per employee/month, while EOR services are higher at RM1,200–RM2,000, depending on scope and risk.

Q3: Are PEO and EOR services legal in Malaysia?

A: Yes. When provided by licensed, reputable firms, both models comply with Malaysia’s labour, tax, and social security laws.

Q4: Can local Malaysian companies use EOR services?

A: Yes. While EOR is popular among foreign businesses, local companies also use it for flexibility in hiring contract staff or managing regional expansions.

Q5: How do PEO and EOR complement accounting services?

A: Payroll, tax, and benefits data from PEO/EOR directly impact financial reporting. Integrated solutions ensure both HR and accounting are compliant and accurate.

Conclusion

- PEO suits businesses with a legal entity that want to outsource HR functions.

- EOR is ideal for foreign firms hiring without an entity or companies wanting full compliance support.

By working with providers that also offer PEO and EOR services in Malaysia alongside accounting services, businesses can enjoy seamless compliance and focus on growth.