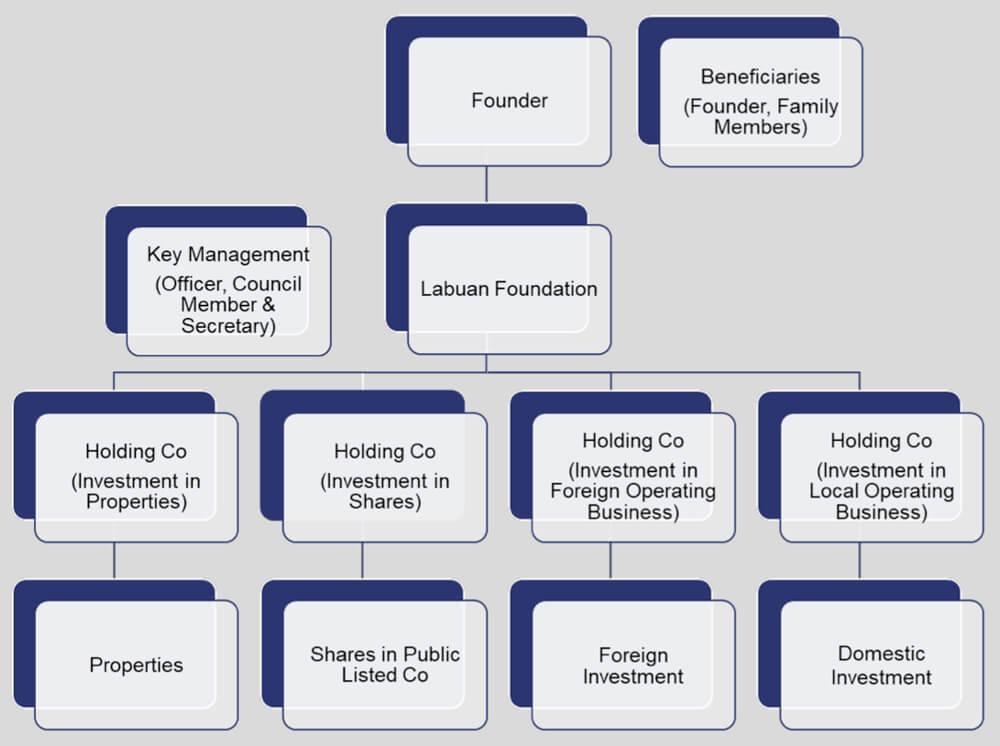

Why Labuan Foundation is Best Choice in Asia as Private Wealth Management Vehicle?

Labuan Foundation is probably one of the Best Choices in Asia as your wealth management vehicle. While there are 21 jurisdictions worldwide which have Foundation Acts to govern wealth management activities, Labuan which is governed by the Labuan Foundation Act 2010, remains the ONLY jurisdiction in Asia. As such, your assets are protected under its own jurisdiction from the local or foreign claims and cannot be liquidated forcefully.

Labuan Foundation has other Silent Features as private wealth management vehicle as below:

- A corporate body with a separate legal entity

- Provided by the Labuan Foundations Act 2010

- Established to manage its own property for any lawful purpose, be it for charitable or non-charitable purposes

Control

Confidentiality

End beneficiaries is anonymous.

Capital Transfer

No capital requirements. Minimum endowment of USD1.00 as an initial asset at time of establishment.

Nationality

No requirement for founder/councillor.

Appeal Against Transfer By Creditors

Only within the first two years of registration.

Appeal Against Inheritance Provisions

No appeal possible because of foreign laws.

Foreign Claim Or Judgment

Unenforceable

Rights And Powers Of A Founder

Enshrined via the charters.

Holding Of Malaysian Assets For Non-charitable Foundations

May hold with Labuan FSA’s approval.

Involvement Of Corporate Body

Allowed to be appointed as :

- Founder

- Council (Can be natural person or a corporation)

- Officer (Can be natural person or a corporation)

- Beneficiary

Duration

Fixed or perpetual.

Dissolution

Assets returned to designated party.

Ownership Of Foundation’s Asset

Beneficiary has no legal or beneficiary ownership over the foundation’s asset.

Taxation On Income