Improving Transfer Pricing Compliance

Transfer Pricing Guidelines (“TPG”)

The 2012 Transfer Pricing Guideline was intended to provide detailed guidance to taxpayers on how to comply with the requirements of the law under Section140A of Income Tax Act 1967 and the TP Rules 2012. The 2012 TPG is applicable to:

- Controlled transactions between associated persons, where at least one party is assessable or chargeable to tax in Malaysia; and

- Applies to both cross-border transactions and domestic related party transactions.

The guidelines reinforces that companies involved in related party transactions in Malaysia should prepare a Transfer Pricing Documentation (“TPD”) for the year of assessment but not required to be submitted unless requested by tax authorities.

Companies who fall below this threshold may opt to prepare a minimal Transfer Pricing Documentation template (from FY 2022 onwards) instead of a full scope Transfer Pricing Documentation. Prior to FY 2022, Companies who fall below the threshold were required to prepare a limited scope Transfer Pricing Documentation.

The IRB released a TPD Flowchart to assists taxpayers in determining the circumstances where full or minimal TPD is required. Companies can be exempted from preparing if any adjustments made does not alter the total tax payable (i.e. both companies do not enjoy incentive, suffer losses or taxed at different rates)

Transfer Pricing Documentation (“TPD”) Flowchart

Transfer Pricing Rules 2023

The Income Tax (TP) Rules 2023 supersedes the rules that was released in 2012 and is effective from the year of assessment 2023. Significant changes were made with the intention to boost compliance and provide taxpayers with more clarity with regards to TP compliance. Some of the important changes that affect the way TPDs will be prepared moving forward:

Contemporaneous TP documentation requirements

A person who enters into a controlled transaction shall prepare a contemporaneous transfer pricing documentation which is brought into existence prior to the due date for furnishing a return in the basis period for a year of assessment in which a controlled transaction is entered into.

As per Transfer Pricing Rules 2023, the contemporaneous transfer pricing documentation shall contain:

- The date of completion in the TPD

- Additional information on the MNE Group that is relevant to the taxpayer’s business in Malaysia. Alternatively, the taxpayer can attach the Master file prepared by the Group or ultimate holding company with the Local TPD.

- A detailed list of information and/or documentation to be included or attached in the Local TPD

- Taxpayers must indicate in the TPD if any of the information or documents required are not applicable to the taxpayers.

- Failure to do so will result in an incomplete TPD.

- For the purposes of this rule MNE means a collection of enterprises related through ownership or control which is required to prepare consolidated financial statements

Method to determine arm’s length price

The person shall ensure that the best method selected and that it can be supported by explanation and reasons to justify the selection. However, the Director General may review the selected method and disregard the taxpayer’s selected method and replace with a different method if they are the opinion that it is not the most appropriate method.

Comparability of transactions

An uncontrolled transaction shall be used as a comparable in determining an arm’s length price of a controlled transaction. A person shall accurately delineate the controlled transaction by identifying the commercial or financial relations between associated person based on the economically relevant characteristics.

Intra-group Services

A person shall demonstrate that the intra-group services have been rendered and the provision of such services has conferred an economic benefit or commercial value to his business and the charge for the intra-group services is justified. Intra-group means services rendered between associated persons. Intra-group services shall be disregarded if it involves:

- Shareholder or custodial activities

- Duplicative services

- Services that provide incidental benefits or passive association benefits

- On-call services

Cost contribution arrangement

A person shall determine the arm’s allocation of cost for such arrangement is in accordance with the allocation that would been undertaken by an independent person in a similar arrangement.

Intangible property

Intangible property” refers to an asset which is neither a physical asset nor a financial asset but such asset is capable of being owned or controlled for use in commercial purposes, whose use or transfer would be compensated had it occurred in a transaction between independent persons in comparable circumstances which includes patent, invention, formula, process, design, model, plan, trade secret, know-how or marketing intangible.

Any party that contributes to the functions above should be entitled to an arm’s length consideration, regardless of legal ownership

Full Scope TPD

A full scope report may consist of the following:

a) Group worldwide organizational structure

b) Description of MNE Group businesses

c) MNE’s intangible assets

d) MNE’s intercompany financial activities

e) MNE’s financial and tax position

f) Local organizational structure and company background

g) Nature of business/industry and market conditions

h) Controlled transactions and Pricing policies including formula adopted and sample documents to justify

i) Assumption, strategies and information regarding factors that influenced the price setting policies

j) Functions, assets and risk analysis including risk analysis framework

k) Comparability analysis

l) Selection and application of the transfer pricing method including basis to justify the selection

m) Financial information

n) Other relevant/supporting documents

Simplified TPD

Prior to FY 2022, Companies that fall outside the scope of the threshold amounting RM25 million for revenue and RM15 million of RPTs. A simplified TP documentation consists of items (f), (h) and (i) as listed above. Taxpayer is allowed to apply any method other than the five methods described in the TPG provided it results in arm’s length outcomes.

f) Organizational Structure

(i) the taxpayer’s worldwide organizational and ownership structure covering all associated persons whose transactions directly or indirectly affect the pricing of the documented transactions; and

(ii) a description of the management structure of the local entity, a local organization chart, and a description of the individuals to whom local management reports and the country(ies) in which such individuals maintain their principal offices.

(h) Controlled Transactions

(i) description of details of the property or services to which transaction relates; any intangible rights or property attached thereto, the participants, the scope, timing, frequency, type and value of the controlled transactions (including all relevant related party dealings in relevant geographic markets);

(ii) names and addresses of all associated persons, with details of the relationship with each such associated person;

(iii) the nature, terms (including prices) and conditions of transactions (where applicable) entered into with each associated person and the quantum and value of each transaction;

(iv) an overview description of the business, as well as a functional analysis of all associated persons with whom the taxpayer has transacted;

(v) all commercial agreements setting forth the terms and conditions of transactions with associated persons as well as with third parties; and

(vi) a record of any forecasts, budgets or any other financial estimates prepared by the person for the business as a whole and for each division or product separately.

(i) Pricing Policies

Details of pricing policy for each type of controlled transaction shall include:

(i) the formula adopted, including anticipated profit margin/mark-up and cost component;

(ii) how the formula is applied;

(iii) who determine the pricing policy & how often is the policy being revised;

(iv) sample of documents to support the pricing policy; and

(v) comparability study to ensure the arm’s length price.

Minimum TPD Template (PIN 1/2023)

The template was originally released in 2022 to simplify compliance for SMEs and reduce administrative burden of compliance. Companies that fall below the threshold can choose to fill in the details requested in the minimum TPD template.

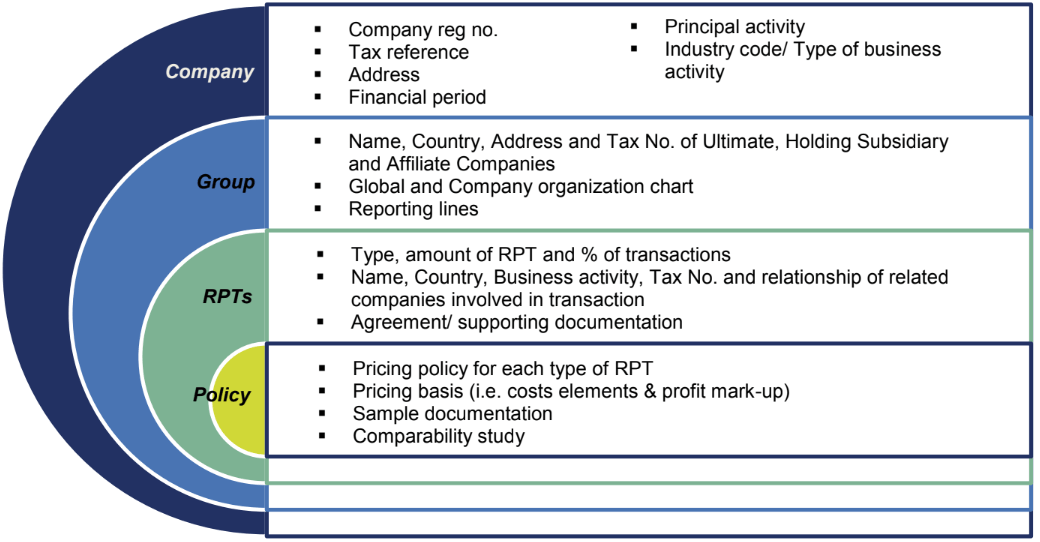

The template is a form that consists of 4 parts as follows:

Income Tax (Country-by-Country Reporting) Rules 2016 (“CbyCR Rules”)

The tax authorities issued the CbyCR Rules followed by the Labuan CbyCR Regulation, effective from 1 January 2017 and is applicable to MNE Groups with total consolidated group revenue of at least RM 3 billion. The rules state that the ultimate parent (reporting entity) would have to complete the CbyC Report and submit it to the tax authorities on or before 12 months from the last day of the reporting FY (i.e. 31 December 2023 if the tax payer’s year end is 31 December 2022).

Additionally, there is also a requirement for the Malaysian Companies to notify the tax authorities under Subrule 6(1) and 6(2) of the PU (A) 357/2016, by disclosing the information in the tax returns or by submitting the manual notification form.

Malaysian parent entities and subsidiaries submitting the Form C , TR , TA , TC or TN can furnish the notification by way of tax returns while companies filing Form LE & TF are required to furnish the notification using a manual notification form:

Reporting entity

[Annex B1]

The reporting entity shall notify the Director General in writing if it is the ultimate holding entity on or before the last day of the FY. Details of all Malaysian and foreign non-reporting constituent entities must be included

Non-reporting entity

[Annex C1 & C2]

The Malaysian subsidiary must notify the Director General in writing of the identity and tax

residence of the reporting entity on or before the last day of the FY.

Tax Return Form

Throughout the year from FY 2014 to FY 2022, the income tax return form has been amended to include additional disclosures as follows:

a) Transfer Pricing Documentation and its related information

Tax payer is to disclose its characterization, other related information and all type of transactions they are involved in with a related party and the amount.

b) Disclosure of whether the taxpayer is subject to interest restriction under Section 140C.

Tax authorities introduced Restriction on deductibility of interest under Section 140C of the Income Tax Act 1967, effective 1 July 2019 onwards aimed at restricting the deduction of interest expense in relation to cross border transaction.

The Rules are applicable to:

- companies who have been granted any financial assistance in a controlled transaction;

- the total amount of any interest expense for all such financial assistance exceeds RM500,000 in the basis period.

The maximum amount of interest that is deductible is 20% of the Tax EBITDA. The balance is allowed to be carried

forward.

c) Disclosure on CbyCR

Tax payer is to disclose if CbyCR is relevant for the Group and fill in the relevant information of the reporting entity.

TP Penalties and Power to Disregard Structures

Failure to furnish contemporaneous TP documentation

With the introduction of Section 113B of the ITA, any person who fails to furnishing a contemporaneous TPD shall be liable to the following:

a) Fine of not less than RM20,000 and not more than RM100,000; or

b) Imprisonment for a term not exceeding six (6) months; or

c) Both.

Taxpayers can appeal on the decision with the Special Commissioners of Income Tax but the burden of proof is on the

taxpayers.

5% surcharge on TP adjustments

Under Section 140A (3C), the Director General may impose a surcharge of not more than 5% of the total transfer pricing adjustments regardless if there is any additional taxes payable by the taxpayers. Any surcharge imposed shall be treated as collection tax.

Power to disregard structure in controlled transactions

Under S140A (3A) and (3B), the Director General will be empowered to disregard any related party transaction structure adopted by the company if he is of the opinion that:

a) The economic substance of that transaction differs from its form; or

b) The commercial reality of that transaction differs from the arrangement which would have been adopted by an

independent party.

In these circumstances, the Director General will be allowed to make adjustments to the structure to reflect the structure

that would have been adopted in a third party arrangement.

Failure to comply (after adjustments have been issued)

Penalties will be imposed under subsection 113(2) and the TP Audit Framework 2019. The rates can range from 30% to 100% depending on whether the TP documentation is prepared contemporaneously

Illustration on Penalties

Key Take-aways

- Tax authorities have provided a cost efficient template for SME companies to encourage compliance

- In addition to the template, taxpayers also need to include documentation or analysis to justify that the RPT is carried out

- at market price (i.e. comparability study)

- While there are exemptions to preparing TPD, it is not always possible determine whether adjustments will result in

- additional tax until the audit is carried out

- Keep in mind that the penalties have not been amended or adjusted for such exemptions. The risk of IRB imposing the

- 5% surcharge on adjustments on top of remaining penalties are still present.

- Burden of proof is on taxpayers to maintain the relevant records, documentation and calculation to justify the arm’s length

- nature of the inter-company transactions

- Taxpayers need to reassess the completeness and robustness of the TPD prepared previously and make amendments

- where necessary

- Even if taxpayer’s results fall within the new definition of the arm’s length range, taxpayers cannot take it for granted that

- no adjustments will be made in the event of an audit.

- Taxpayers must not take lightly the importance of justifying the selected TP method as the best possible method

How We Can Help

Our dedicated team of professionals has experience in various disciplines to respond effectively and efficiently to our clients’ individual requirements. This professional capability allows us to advise and plan strategies critical to our clients’ needs and success within the challenges of the present business environment.

Our service includes a total approach to our clients’ problems and needs. Using a team approach, our services are tailored to meet our clients’ individual requirements. We stress on a high degree of competence, professionalism and commitment among our team members.

We offer the following services with a clear focus on the business issues and regulatory requirements of the client’s industry:

- Audit and Assurance

- Tax & Transfer Pricing Advisory and Compliance

- Business Advisory

- China Desk

- Financial and Transaction Advisory

- Risk, Governance and Sustainability Advisory

- Valuation Advisory

- Migration Advisory

- Offshore Advisory

Should you have any questions or require any assistance on the above, please do not hesitate to drop us an email or call us.

For more information, please view from PDF below