Why Labuan?

TAX BENEFITS

1. Corporate Tax 3%

3

200,000

100,000

2

100,000

- Labuan first party captive insurer or Labuan first party captive takaful; or

- Labuan third party captive insurer or Labuan third party captive takaful.

2

2

100,000

100,000

3

200,000

3

- 10 or less related Labuan leasing companies or Labuan Islamic leasing companies;

- 11 to 20 related Labuan leasing companies or Labuan Islamic leasing companies;

- 21 to 30 related leasing companies or Labuan Islamic leasing companies;

- More than 30 related Labuan leasing companies or Labuan Islamic leasing companies

2 per group

3 per group

4 per group

Increase of 1 employee for every additional 10 related companies or Labuan Islamic leasing companies;

100,000 for each Labuan leasing company or Labuan Islamic leasing companies;

100,000 for each Labuan leasing company or Labuan Islamic leasing companies;

100,000 for each Labuan leasing company or Labuan Islamic leasing companies;

100,000 for each Labuan leasing company or Labuan Islamic leasing companies;

2

2

100,000

2

2

100,000

2

2

100,000

2

2

100,000

- provision of treasury processing services and such other services as defined in Section 129 of the Labuan Financial Services and Securities Act 2010.

2

100,000

2

120,000

2

- administrative services – services pertaining to employee management, payroll management, property management, human resource management, financial planning, contract or subcontract management, facilities management or proposal management.*

- accounting services – services pertaining to recording, analysing, summarizing or classifying financial, commercial and business transactions and information of a person or business.*

- legal services

i. conveyancing services*

ii. legal advisory services*

iii. litigation or legal representation services in any proceedings before any court, tribunal or other authority

iv. legal dispute resolution services including alternative dispute resolution. - backroom processing services – services relating to settlements of receivables and payables, clearance, record maintenance, regulatory compliance or information technology (IT) related services which are usually performed by administration and support personnel who do not deal directly with client.

- Payroll services

– services relating to

i. processing, calculation, payment and deduction of remuneration, benefits, tax and statutory payment

ii. issuance of payslip and tax statement - talent management services – services relating to the provision of human resource services to attract, onboard, develop, motivate, and retain employees.*

- agency services – services relating to the provision of specific services on behalf of another group, business, or person pursuant to an agency agreement between the agent and its client.*

- insolvency related services – services related to administering company liquidations or winding up or personal bankruptcy.*

- management services other than Labuan company management under item 17

– organization and coordination of activities of a business in order to provide services to the clients and usually consist of organizing, supervising, monitoring, planning,controlling and directing business’s resources such as human, financial and technology*

2

50,000

1

20,000

20,000

Regulation 3, The Labuan Business Activity Tax (Requirements for Labuan Business Activity) Regulation 2021 which is deemed to have come into operation on 1 January 2021, requires the above mentioned company to comply with the following:

- meeting of the board of directors is convened in Labuan at least once a year;

- the registered office of the Labuan entity shall be situated in Labuan;

- the secretary of the Labuan entity appointed under the Labuan Companies Act 1990 shall be resident in Labuan;

- the accounting and business records including the minutes of meeting of the Labuan entity’s board of directors shall be kept in Labuan;

Income derived from intellectual property rights is subject to tax at the rate of 17% or 24% under Income Tax Acts 1967(“ITA”)

With effect from 1 Jan 2019, under Income Tax (Deductions Not Allowed for Payment Made to Labuan Company by Resident) Rules 2018 (Amendment) 2020, the following type of payments made to a Labuan Entity by a company resident in Malaysia are not entitled to a tax deduction:

2) 0% ON SERVICE TAX AND 6 % ON IMPORTED SERVICE

No service tax shall be charged on any taxable service provided within or between Special Areas and Designated Areas unless on the taxable services prescribed in the Service Tax (Imposition of Tax for Taxable Service in Respect of Designated Areas and Special Areas) Order 2018.

3) 0% ON WITHHOLDING TAX

There is no withholding tax on dividends paid by a Labuan Company in respect of dividends distributed out of income derived from Labuan business activities or income exempt from income tax. Interest, royalties, lease rental, technical fee and management fees paid to a non- resident are not subject to withholding tax.

4) 0% ON STAMP DUTY

5) 100% EXEMPTION OF DIRECTOR’S FEE RECEIVED BY NON-CITIZENS INDIVIDUAL

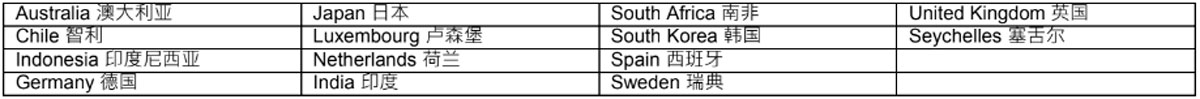

6) DOUBLE TAXATION AGREEMENT (DTA) WITH MORE THAN 70 COUNTRIES

Malaysia has entered into Double Taxation Agreements with various countries as follows:-

# Income Tax Exemption Order

@ Synthesized text

7) LIBERAL LABUAN EXCHANGE CONTROL ENVIRONMENT – FREE FLOW OF FUNDS

8) INVESTMENT PROTECTION AGREEMENT (IGA) WITH MORE THAN 50 COUNTRIES

9) THE CONFIDENTIALITY OF COMPANY, SHAREHOLDER AND DIRECTORS’ INFORMATION IS ENSURED

10) LABUAN COMPANY VS BVI COMPANY

BVI enjoys only 2 countries’ (Japan and Switzerland) double tax treaties (DTAs), and these treaties are not used in practise.

Dividend declared from Labuan Co to Malaysia is free of tax.

Note: If the company is Non-Malaysian Co, the tax exemption will depend on each home country’s law jurisdiction and its double tax treaties with Malaysia.

No withholding tax on interest payment.

BVI has applied the European Union (EU) Savings Directive since 1 July 2005. A withholding tax (initially 15%, rising to 20% from 1 July 2008) has been applied to interest payments to natural persons resident within the EU.

Labuan has its registered auditor under its jurisdiction. The income tax payable is allowed to base on the audited profit, the source of income is cleared for reinvestment or dividend purpose, once it is paid.

BVI has no registered auditor under its jurisdiction.

ILLUSTRATIONS ON LABUAN COMPANY STRUCTURE

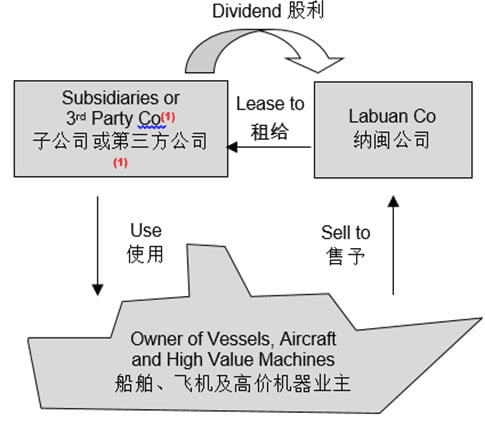

1) Labuan Leasing Company or Labuan Islamic Leasing Company

Suitable Industries

- Vessel, aircraft, shipping, oil & gas, high value assets co.

Tax Advantages

- Income tax is only 3% of net profit

- Dividend income received by Labuan Co is exempted from tax.

- No withholding tax on dividend declared And lease rental made by Malaysian subsidiaries or 3rd Party Malaysian Co.

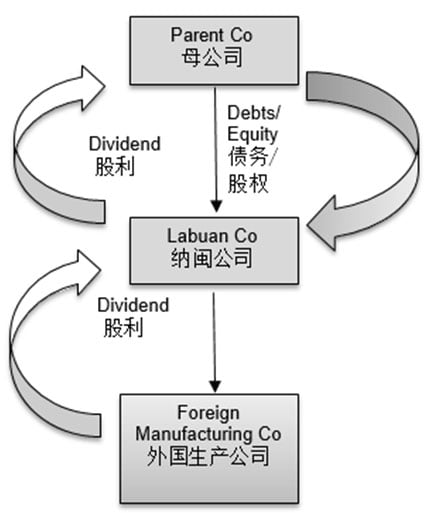

2) Investment Holding Company

Suitable Industries :

- Investment holding or offshore investment.

Tax Advantages

- Dividend income received by Malaysian Parent Co(1) or Labuan Co is exempted from tax.

- No withholding tax on dividend declared by Labuan Co to either Malaysian or Foreign Parent Co.

- No withholding tax on interest charged by Malaysian or Foreign Parent Co to Labuan Co.

- No Capital Gain Tax and stamp duty for the transfer of shares in Labuan Co, e.g. dispose the investment in Foreign Manufacturing Co by selling Labuan Co.

- Enjoys double tax treaties with more than 70 countries via a Labuan Co.

3) Captive Insurance

Suitable Industries :

- Captive Insurance

Tax Advantages

Income tax is only 3% of net profit

- Dividend income received by Malaysian Parent Co(1) is exempted from tax.

- No withholding tax on dividend declared by Labuan Captive Insurance Co.

- Enjoys double tax treaties with more than 70 countries via a Labuan Co.

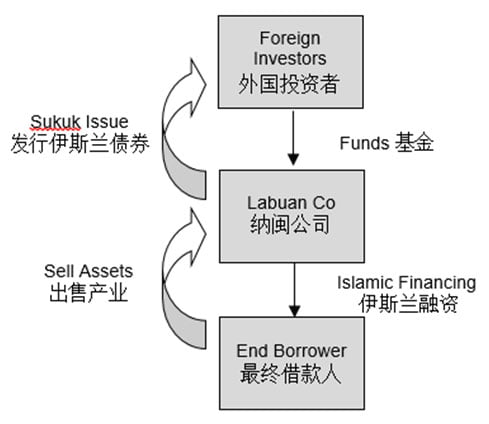

4) Offshore Financing

Suitable Industries :

- Fund managers

Tax Advantages

- Income from investment is exempted from tax for Labuan Co.

- Dividend from Labuan Co is exempted from tax.

- No withholding tax either on dividend declared by or interest charged from Labuan Co to Labuan Funds.

- Distribution from Labuan Funds to investors is not subject to withholding tax.

- Enjoys double tax treaties with more than 70 countries via a Labuan Co.

Other Advantages

- Lower cost of funds.

- Liberal Labuan exchange control environment.

- Debt instruments of Labuan Co may be listed.