New 2023 Transfer Pricing Rules

TP Rules 2023

The Income Tax (TP) Rules 2023 supersedes the rules that was released in 2012 and is effective from

the year of assessment 2023. Significant changes were made with the intention to boost compliance

and provide taxpayers with more clarity with regards to TP compliance. Some of the important changes

that affect the way TP documentations (“TPD”) will be prepared moving forward is as follows:

TP Rules 2023 – Detailed Description

- “Contemporaneous” TPD must be prepared before the filing of the tax return for the relevant year of assessment.

- While this is not a new requirement, it has now been made clearer in the rules and it allows the Tax Authorities to penalize taxpayers who did not prepare the TPD in a timely manner.

- The requirement to include the date of completion in the TPD is in line with the Tax Authorities’ intention to increase compliance and to have concrete written evidence as to whether the TPD was prepared before or after the filing of the tax returns.

- Contemporaneous Full TPD must now include additional information on the MNE Group that is relevant to the taxpayer’s business in Malaysia. Alternatively, the taxpayer can attach the Master file prepared by the Group or ultimate holding company with the Local TPD.

- Previously this requirement was only applicable for Group of Companies that is required to submit the Country-by-Country Report.

- In the absence of any Master File, the local taxpayer will have to request for this information from the ultimate parent company to include in the Local TPD.

- The Tax Authorities have also included a detailed list of information and/or documentation to be included or attached in the Local TPD.

- Based on the above, taxpayers must indicate in the TPD if any of the information or documents required are not applicable to the taxpayers. Failure to do so will result in an incomplete TPD.

- Previously the Guidelines requests taxpayers to select the TP method on a hierarchy basis which means that the Comparable Uncontrolled Price (“CUP”) must be considered first before the other methods on the list.

- However, now the requirement is that the best method is selected and can be supported by explanation and sufficient reasoning to justify the selection.

- There is also a clause that allows the Director General to disregard the taxpayer’s selected method and replace with a different method if they are the opinion that it is not the most appropriate method.

- The Tax Authorities general practice or expectation previously was for taxpayers to achieve results that is above the median of the benchmarking analysis or to make an adjustment to the median of the benchmarking.

- The new rules have included a definition for the arm’s length range from 37.5 percentile to 62.5 percentile and that Companies’ who fall within the range may be regarded as arm’s length.

- However, taxpayers should be aware that the Director General has the power to make any TP adjustment to the median or any other point above median and within the arm’s length range if there is reason to believe that the comparable companies selected is not suitable.

- The Director General may allow for use of data from the review period and prior years if it can be proven that life cycles or business cycles of the property/services are not impacted by the conditions of commercial or financial relations between associated persons.

- However, this can only be used to assist in the selection of comparable and not for the use of multiple year averages.

- Previously this dateline was only included in the TP Guidelines. It has not been included in the Rules as well.

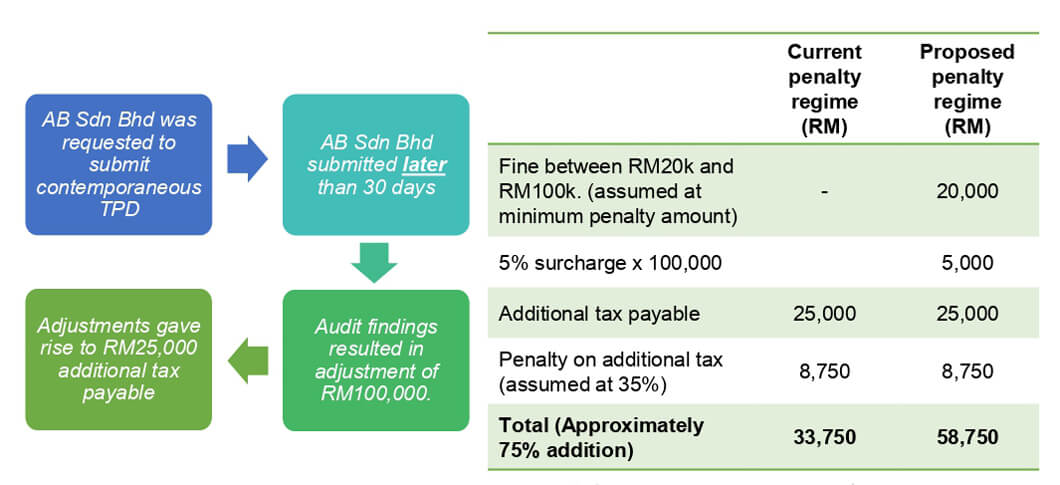

- Failure to submit the TPD within 14 days will result in penalties even if there is no adjustments made or additional taxes payable.

- Emphasizes the importance of the Development, Enhancement, Maintenance, Protection and Exploitation (“DEMPE”) analysis for intangible property

- Any party that contributes to the functions above should be entitled to an arm’s length consideration, regardless of legal ownership

Key Take-aways

- Burden of proof is on taxpayers to maintain the relevant records, documentation and calculation to justify the arm’s length nature of the inter-company transactions

- Taxpayers need to reassess the completeness and robustness of the TPD prepared previously and make amendments where necessary

- Even if taxpayer’s results fall within the new definition of the arm’s length range, taxpayers cannot take it for granted that no adjustments will be made in the event of an audit.

- Taxpayers must not take lightly the importance of justifying the selected TP method as the best possible method