Malaysia My Second Home (MM2H) Programme

Malaysia My Second Home (MM2H) Programme is a programme promoted by the Government of Malaysia to allow foreigners who fulfil certain criteria to obtain multiple-entry social visit pass to stay in Malaysia.

Malaysia My Second Home (MM2H) Programme

- Malaysia My Second Home (MM2H) Programme is a programme promoted by the Government of Malaysia to allow foreigners who fulfil certain criteria to obtain multiple-entry social visit pass to stay in Malaysia.

- Multiple-entry social visit pass valid for 5 to 20 years and is renewable.

- This programme opens to all citizens from all the countries recognised by Malaysia, regardless of religion, race, gender and age.

- Principal applicants are allowed to bring their spouse, unmarried children below the age of 21 and parents.

- More than 50,000 participants around the world participate in this programme.

Why Malaysia

- This programme is promoted by the Government of Malaysia.

- Multilingual country, no difficulties on daily communication.

- No natural disaster and political stable.

- Comprehensive Educational System.

- Comprehensive healthcare system and services.

Benefits of MM2H

- From a period of five (5) years, and is renewable.

- Unlimited access to Malaysia.

- Pension remitted to Malaysia are eligible to tax exemption, such as Fixed Deposit.

MM2H REQUIREMENT – PLATINUM, GOLD, SILVER

Category & Requirement

Platinum

Gold

Silver

1. Fixed Deposit

RM 4,500,000

(USD 1,000,000)

(USD 1,000,000)

RM 2,000,000

(USD 500,000)

(USD 500,000)

RM 630,000

(USD 150,000)

(USD 150,000)

2. Purchase of Residential Property

RM 2,000,000 and above

RM 1,000,000 and above

RM 600,000 and above

3. Maximum Withdrawal from Fixed Deposit

50%

4. Minimum length of stay

90 days per annum

5. Dependents

Spouse, Children, and Parents

6. Business / Investment Activities

Permissible

Not allowed

7. Career Opportunities

Permissible

Not allowed

8. MM2H Pass Renewable

20 Years

15 Years

5 Years

MM2H REQUIREMENT – SPECIAL ECONOMIC ZONE (SEZ)

Category & Requirement

Special Economic Zone

1. Special Economic Zone Area

a) Forest City

b) Iskandar Puteri

c) Johor Bahru City Centre

d) Pasir Gudang

e) Kulai

f) Pontian

f) Pontian

2. Fixed Deposit

USD 65,000 (Age 21-49)

USD 32,000 (Age above 50)

3. Purchase of Residential Property

No Limit, but need to directly purchase from Developer. (Cannot sell for Ten years)

4. Maximum Withdrawal from Fixed Deposit

50%

5. Minimum length of stay

90 days per annum

6. Dependents

Spouse, Children, and Parents

7. Business / Investment Activities

Not allowed

8. Career Opportunities

Not allowed

9. MM2H Pass Renewable

10 Years

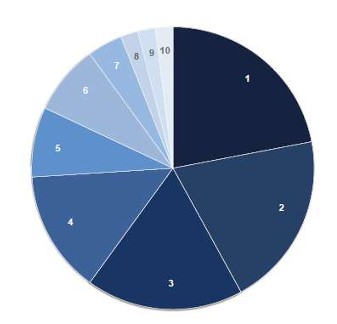

MM2H PROGRAMME STATISTIC

2002 to 2019*(Top 10)

*For 2019, only data on applications – not approvals – are available

People’s Republic of China

15,883

Japan

5150

People’s Republic of Bangladesh

4,335

Republic of Korea

3,093

United Kingdom

2,892

Hong Kong S.A.R

1,691

Republic of Singapore

1,611

Republic of China (Taiwan)

1,518

Islamic Republic of Iran

1,428

Republic of India

1,150

Others

9,720