PENGERANG INTEGRATED PETROLEUM COMPLEX (“PIPC”)

Special Incentive Package for Manufacturing Sector

PIPC offers highly attractive tax incentives packages for manufacturing investors, including up to 10 years of income tax exemption, customs duty exemptions on importation of machinery, equipment and raw materials and reduced tax rates on qualifying activities.

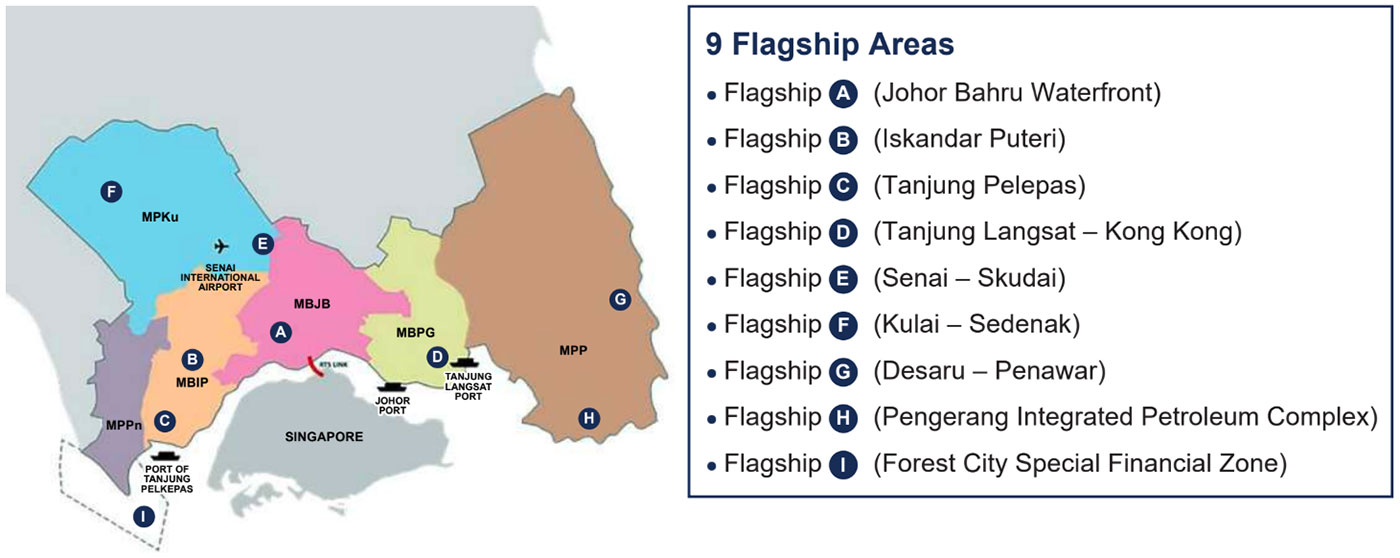

Strategically located in Johor, Malaysia, the Pengerang Integrated Petroleum Complex (PIPC) is a fully integrated

oil and gas megaproject that positions Malaysia as a leading energy and petrochemical hub in Southeast Asia. With

world-class infrastructure, deepwater port access, and strong government support, PIPC offers investment

opportunities in the downstream and midstream sectors.

Attractive Tax Incentives

Incentive Type

Details

1.

Special Income Tax Rate

- 5% or 10% tax rate for up to 10 years on qualifying income; OR

2.

Investment Tax Allowance (ITA)

- 60% or 100% capital expenditure allowance for up to 10 years;

- Offset up to 100% of statutory income for each assessment year.

Import Duty and Sales Tax Exemptions

Exemptions on machinery, equipment, raw materials, and components used in qualifying manufacturing activities.

Stamp Duty Exemptions

Potential exemptions on property transfers and loan agreements related to approved projects.

Eligible Activities and Products

Production and processing of chemical and petrochemical products:-

i. Base Chemical – Methanol, Ethylene, Propylene, Benzene, Aromatics

ii. Organic Intermediates – C1 to C6 ;

iii. Specialty Chemical;

iv. Fertilisers;

v. Polymers/ Plastics;

vi. Oleochemical/ Biochemical

i. Base Chemical – Methanol, Ethylene, Propylene, Benzene, Aromatics

ii. Organic Intermediates – C1 to C6 ;

iii. Specialty Chemical;

iv. Fertilisers;

v. Polymers/ Plastics;

vi. Oleochemical/ Biochemical

Who Can Apply

- Local and foreign companies incorporated in Malaysia;

- A minimum capital investment of RM500 million in qualifying manufacturing activities within PIPC.

This incentive is eligible to be considered for application received by Malaysian Investment Development Authority

(“MIDA”) from 14th October 2023 to 31st December 2028.