WHY SINGAPORE

Singapore is a strategic base to implement your

growth strategies and to manage and integrate your

operations for the region and beyond. Being one of the

lowest income tax rate countries, Singapore has

further announced a full and partial tax exemption for

the newly incorporated company for

the first 3 years consecutively.

1) One of the LOWEST TAX RATES in the world

With effect from 2010, Singapore corporate income tax rate has further reduced from 18% to 17%, being one of the lowest tax rates in the world. Singapore Government has declared a new start-up tax exemption and partial tax exemption for newly incorporated and existing companies:

Tax Exemptions for Newly Start-up Companies in Singapore vs Malaysia

4.25% tax on first S$100K chargeable income

For a newly incorporated company (1), the corporate income tax rate is 4.25% on the first S$100k (≈RM300k) of chargeable income for the first 3 years of assessment consecutively.

8.50% tax on chargeable income of above S$100K up to S$200K

The newly incorporated companies are continued to enjoy for the partial tax exemption which effectively translates to about 8.5% tax rate on

chargeable income of above S$100,000 up to S$200,000 per annum. The chargeable income above S$200,000 will be charged at the normal

headline corporate tax rate of 17%.

Tax Exemptions for Existing Companies in Singapore vs Malaysia

The 4th years of assessment and onwards, the companies pay only 4.25% tax on their first S$10,000 of chargeable Income and 8.50% for the next

S$190,000. The chargeable income above S$200,000 will be charged at the normal headline corporate tax rate of 17%.

1. (a) It is incorporated in Singapore and a tax resident of Singapore for that Year of Assessment. (b) It has no more than 20 shareholders throughout the basis period

relating to that Year of Assessment and all its shareholders are individuals throughout the basis period relating to that Year of Assessment; or there is at least one

individual shareholder with a minimum of 10% shareholding. c) Its principal activity is not related to (i) investment holding, or (ii) property developer for sales, investment, and both.

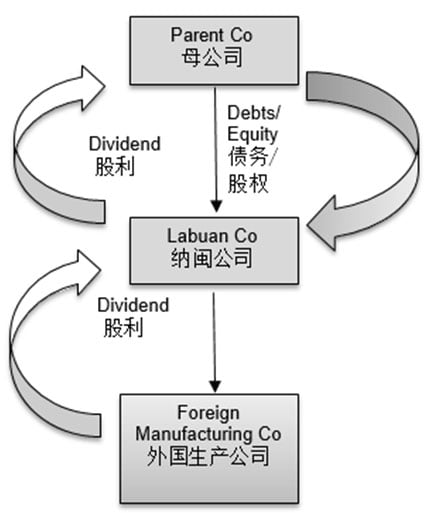

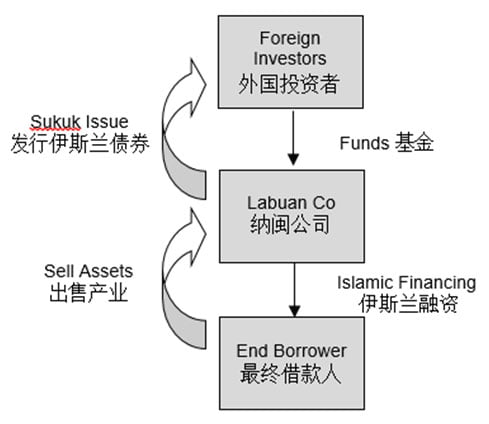

2) Engage in TRIANGULAR or TETRAGONAL trade

The companies engaged in international transactions among two or more countries, for instance, the companies purchase goods from e.g. China,

and then sell them to e.g. America or trade domestically, Malaysia. This is when the companies need a lower tax trading company (2) to act as the intermediary to issue invoice and packing list in order to strengthen their competitive power in the international or local market.

2. To consider a company as resident in Singapore, the control and management of the business must be exercised in Singapore. Though the term “control and

management” is not clearly defined by authorities, a generally accepted consensus is that it refers to the policy level decision making at the level of Board of Directors.

3) Government Incentives

Overview of government incentives

Depending on your company’s business plans, you may consider various tax incentives and grants as follows:

Internationalisation

Incentives available

Benefits

International Headquarters (IHQ) Award

Concessionary corporate tax rates of 5% or 10% for companies that commit to

anchor substantive HQ activities in Singapore to manage, coordinate and control

regional business operations. The award is accompanied with the award of

Development and Expansion Incentive governed by Singapore Economic

Development Board (EDB).

Mergers & Acquisitions (M&A) Scheme

The acquiring company is entitled to the following benefits:

- 25% of M&A allowance (capped at S$10 million) of the total acquisition value capped at S$40 million per YA.

- Double Tax Deduction (DTD) on the transaction cost capped at S$100,000 incurred during the share acquisition process.

Double Tax Deduction (DTD) for

Internationalisation Scheme

Enjoy up to 200% tax deduction on qualifying expenditure incurred on market

expansion and investment development activities.

The qualifying expenditures include:

- Qualifying salary expenses incurred for employees posted overseas in an overseas entity.

- Overseas business development trips and missions.

- Overseas investment study trips and missions.

- Overseas trade fairs.

- Local trade fairs approved by Enterprise Singapore or STB.

Market Readiness Assistance (MRA) grant

Funding support of 50% of eligible costs, capped at S$100,000 per company per new

market by Enterprise Singapore. The eligible costs for marketing activities including

overseas market set-up, business development and market promotion.

Trading

Incentives available

Benefits

Global Trader Programme

A concessionary corporate tax rate of 5% or 10% for a renewable 3 or 5-year period

on qualifying trading income granted by Enterprise Singapore, which includes income

from physical trading, brokering of physical trades, derivative trading income, and

income from structured commodity financing activities, treasury activities and

advisory services in relation to mergers and acquisitions.

Manufacturing and services

Incentives Available

Benefits

Pioneer Incentive

Tax exemption on income from qualifying activities for a period of not exceeding 15

years, administered by Economic and Development Board (EDB).

Development & Expansion Incentive (DEI)

Reduced tax rate of 5% or 10% on incremental income from qualifying activities,

limited to 5 years. The incentive is governed by Economic and Development Board

(EDB).

Investment Allowance (IA)

Allowance of up to 100% (on top of normal capital allowance) on approved fixed

capital expenditure. This incentive is administered by Economic and Development

Board (EDB).

Integrated Investment Allowance (IIA)

Additional allowance on fixed capital expenditure incurred on qualifying productive

equipment placed with an overseas company for an approved project. This scheme

is administered by Economic and Development Board (EDB).

Land Intensification Allowance (LIA)

Initial allowance of 25% and annual allowance of 5% on qualifying capital expenditure

incurred for the construction or renovation/extension of a qualifying building or

structure. Annual allowances of 5% are granted until total allowance amounts to 100%

of qualifying capital expenditure. Approvals for the incentive will be granted by the

Economic Development Board (EDB).

Automation Support Package (under Enterprise

Singapore)

- Enterprise Development Grant (EDG)

- Investment Allowance (IA)

- Enhanced SME Equipment Loan

Grant support up to 70% of qualifying project costs such as equipment, training and

consultancy.

Qualifying projects may be eligible for an IA of 100% on the amount of approved capital expenditure, net of grants. The approved capital expenditure is capped at S$10 million per project.

Under Enterprise Financing Scheme (EFS), qualifying SMEs may receive up to 70% government’s risk-share with participating financial institutions for qualifying projects. SMEs can apply for fixed asset loans of up to S$30 million. ことができる。

Qualifying projects may be eligible for an IA of 100% on the amount of approved capital expenditure, net of grants. The approved capital expenditure is capped at S$10 million per project.

Under Enterprise Financing Scheme (EFS), qualifying SMEs may receive up to 70% government’s risk-share with participating financial institutions for qualifying projects. SMEs can apply for fixed asset loans of up to S$30 million. ことができる。

Financial and Treasury

Incentives available

Benefits

Finance & Treasury Centre (FTC) Incentive

Enjoy concessionary corporate tax rate of 8% for five years on income derived from

qualifying services/ activities as well as withholding tax exemption on interest

payments on loans from banks and approved network companies for FTC activities.

This incentive is administered by Economic and Development Board (EDB).

Financial Sector Incentive (FSI)

Concessionary tax rate of 10% or 13.5% for licensed financial institutions, from large

universal banks, fund managers to capital market players. This incentive is governed

by Monetary Authority of Singapore (MAS).

Research and Development (R&D) and intellectual property (IP) management

Incentives available

Benefits

Research Incentive Scheme for Companies

(RISC)

Co-funding to encourage and assist businesses companies in Singapore to conduct or expand their research and development (R&D) activities in science and technology. This scheme is administered by Economic and Development Board (EDB).

Supportable project costs include expenditure in the following:

- Manpower cost (up to 50% support)

- Equipment, materials, consumables and software (up to 30% support)

- Singapore-based professional services (up to 30% support)

- IPRs, e.g. licensing, royalties, technology acquisition (up to 30% support)

Intellectual Property Development Incentive (IDI)

Reduced tax rate of 5% or 10% on a percentage of qualifying IP income for an initial

period of not exceeding 10 years, and may be further extended for a period or

periods not exceeding ten years each. This incentive is administered by Economic

and Development Board (EDB).

Approved Foreign Loan Incentive (AFL)

Reduced or nil withholding tax rate on interest payments on loans with minimum

amount of S$20 million taken to purchase productive equipment. This incentive is

administered by Economic and Development Board (EDB).

Approved royalties incentive (ARI)

Reduced or nil withholding tax rate on approved royalties, fees or contributions to

research and development costs made to a non-tax resident.. This incentive is

administered by Economic and Development Board (EDB).

Writing-down allowances for IP acquisition

(S19B)

Automatic 5/10/15-year writing-down allowances on capital expenditure incurred for

IPR acquisitions with legal and economic ownership. EDB’s approval is required if only

economic ownership of IP rights is acquired.

Maritime, shipping and logistics

Incentives Available

Benefits

Maritime Sector Incentive (MSI) – Singapore

Registry of Ships (MSI-SRS) and Approved

International Shipping (MSI-AIS)

Tax exemption on qualifying shipping income from operating Singapore and foreign-

flagged ships, provision of specified ship management services, and income from

foreign exchange and risk management activities which are carried out in connection

with or incidental to the operations of ships for either a 10-year renewable period; or

a 5-year non-renewable period, with the option of graduating to the 10-year renewable

award at the end of the 5-year period. This incentive is administered by Maritime and

Port Authority of Singapore (MPA).

MSI – Shipping Related Support Services (MSI-

SSS) Award

Concessionary tax rate of 10% on the incremental income derived from carrying out

approved shipping-related support services for a 5-year renewable period. This

incentive is administered by Maritime and Port Authority of Singapore (MPA).

- Ship broking;

- Forward freight agreement (FFA) trading;

- Ship management;

- Ship agency;

- Freight forwarding and logistics services; and

- Corporate services rendered to qualifying approved related parties who are carrying on business of shipping – related activities.

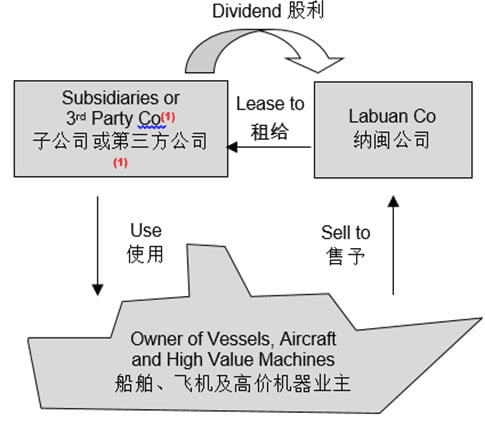

MSI – Maritime Leasing (MSI-ML) Award

Concessionary tax rate of 10% for up to 5 years on qualifying leasing or management

income. This incentive is administered by Maritime and Port Authority of Singapore

(MPA).

Maritime Innovation & Technology (MINT) Fund

To promotes and encourages upstream research, product and solution development

relevant to the maritime industry in Singapore. This incentive is administered by

Maritime and Port Authority of Singapore (MPA).

Grant of up to 70% of the total qualifying project costs (inclusive of input GST), comprising of manpower and equipment either engaged or acquired for the purposes of the project, and other operating expenditure incurred for the purposes of the project.

Grant of up to 70% of the total qualifying project costs (inclusive of input GST), comprising of manpower and equipment either engaged or acquired for the purposes of the project, and other operating expenditure incurred for the purposes of the project.

4) TAX EXEMPTION on Dividend declared from Singapore

Dividend declared out of the profit derived from Singapore Company and received in Malaysia is exempted from tax (3).

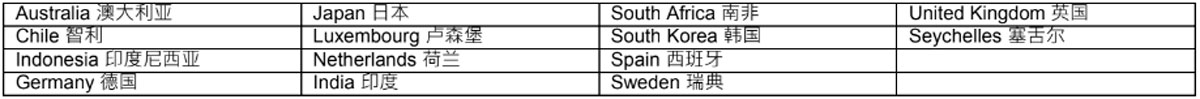

5) TAX TREATIES

Singapore has entered into Double Taxation Agreement (“DTA”) with 88 countries. Please refer to APPENDIX I.

6) AUDIT EXEMPTION of a Singapore Company

A company incorporated on or after 1 July 2015, if a private company that fulfils at least two of the following three quantitative criteria in each of

the immediate past two financial years is exempted from audit (4)

: (a) Total annual revenue of not more than SGD 10 million; (b) Total assets of

not more than SGD 10 million; (c) Number of employee of not more than 50.

3. Section 127 (1) – Exemptions from tax. Any income specified in Part 1 of Schedule 6 shall be exempt from tax. Part 1 Schedule 6, para 28 (1), Income of any

person, other than a resident company carrying on the business of banking, insurance or sea or air transport, for the basis year of assessment derived from sources

outside Malaysia and received in Malaysia Part 1 schedule 6, para 28(1), exempt income of any person derive from sources outside Malaysia and received in

Malaysia (See also exception).

4. Existing safeguards will however be retained, such as requiring all companies to keep proper accounting records, and empowering shareholders with at least 5% voting rights to require a company to prepare audited accounts.

4. Existing safeguards will however be retained, such as requiring all companies to keep proper accounting records, and empowering shareholders with at least 5% voting rights to require a company to prepare audited accounts.